The Features of FreeAgent

When you sign up with Bluebird Accountancy, you will instantly gain access to your own state-of-the-art accountancy platform on FreeAgent. All of the important information regarding your business’s finances will be available to you live and at the click of a button.

With the ongoing support from your professional Bluebird Accountancy Account Manager who will have read-only access to your FreeAgent account, you will be perfectly set up to flourish as a prosperous business owner.

If you want to see how your FreeAgent portal will look, check out our FreeAgent tutorial videos.

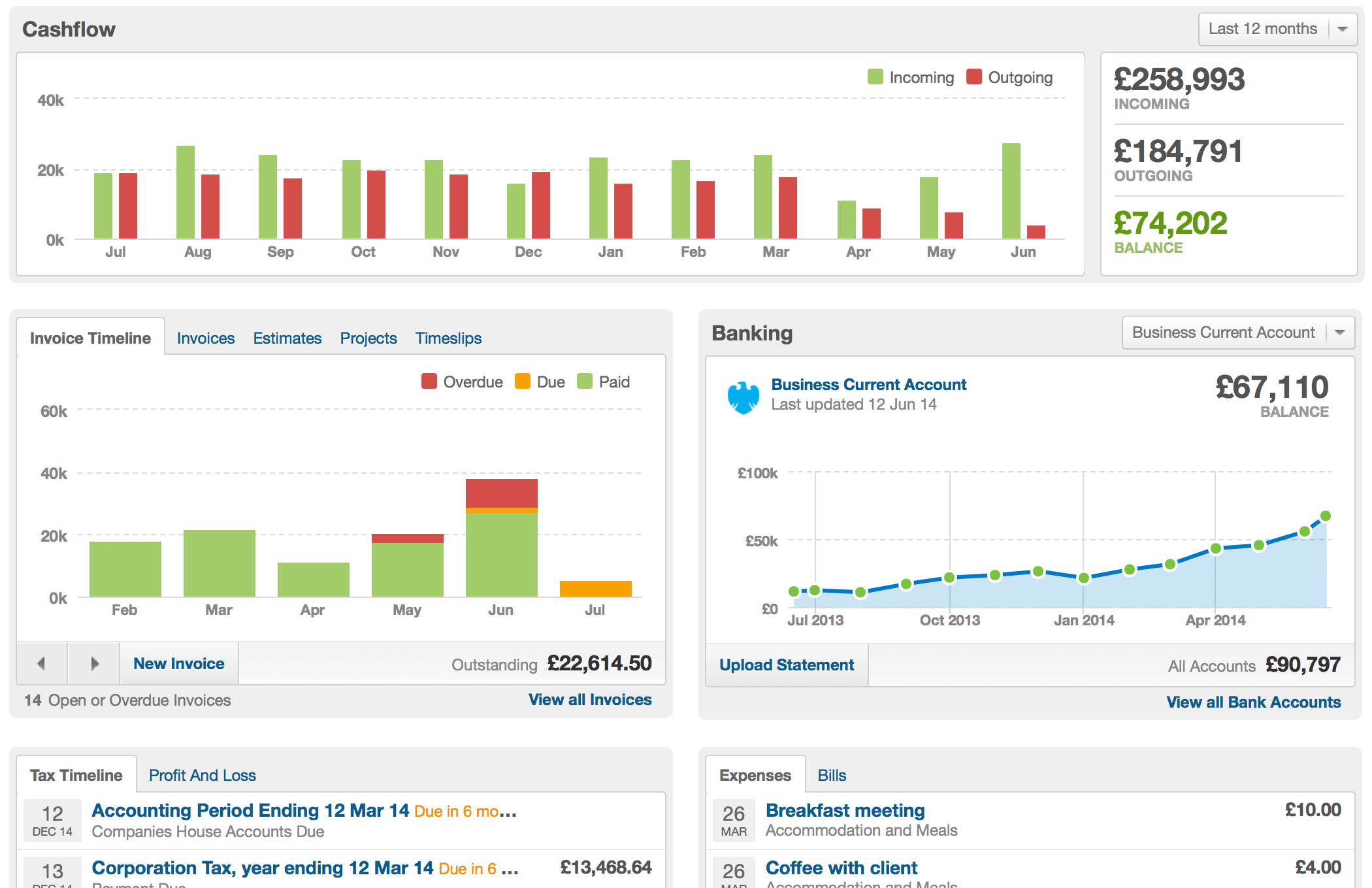

Your own dashboard

When you login to your FreeAgent account, the first page you see will be your dashboard. This will provide you with an overview of the most important information regarding your business finances, including a live bank feed, recent expenses, invoices, and more.

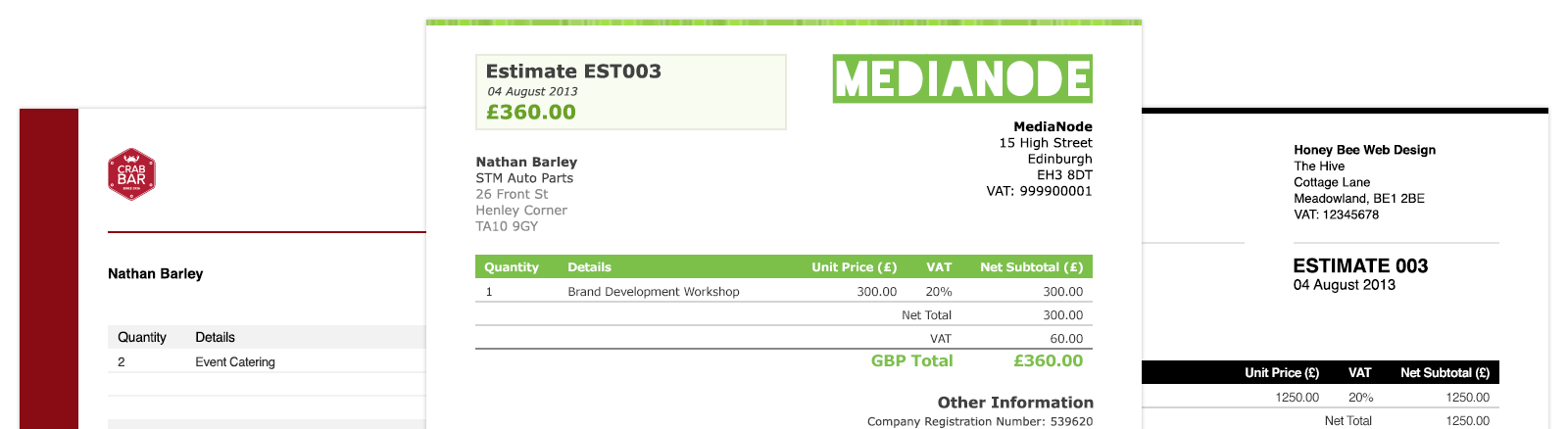

Easy estimates and accurate invoicing

FreeAgent will allow you to access a variety of easily customisable templates for estimates and invoices. Simply upload your business logo and add the important pieces of information such as your address – and you’re ready to start sending professional and branded documentation to your clients.

Monitor expenses

Easily track your expenses by photographing your receipts and uploading to your FreeAgent account in seconds. You can view a list of all of your expenses so you are always aware of the tax you are entitled to claim back at the end of the tax year.

Tracking your time

In order to make sure you are charging your client for the correct amount of hours, FreeAgent allows you to easily submit time slips. These will help you identify exactly how long you have spent on each assignment, just like an ongoing diary but without the hassle.

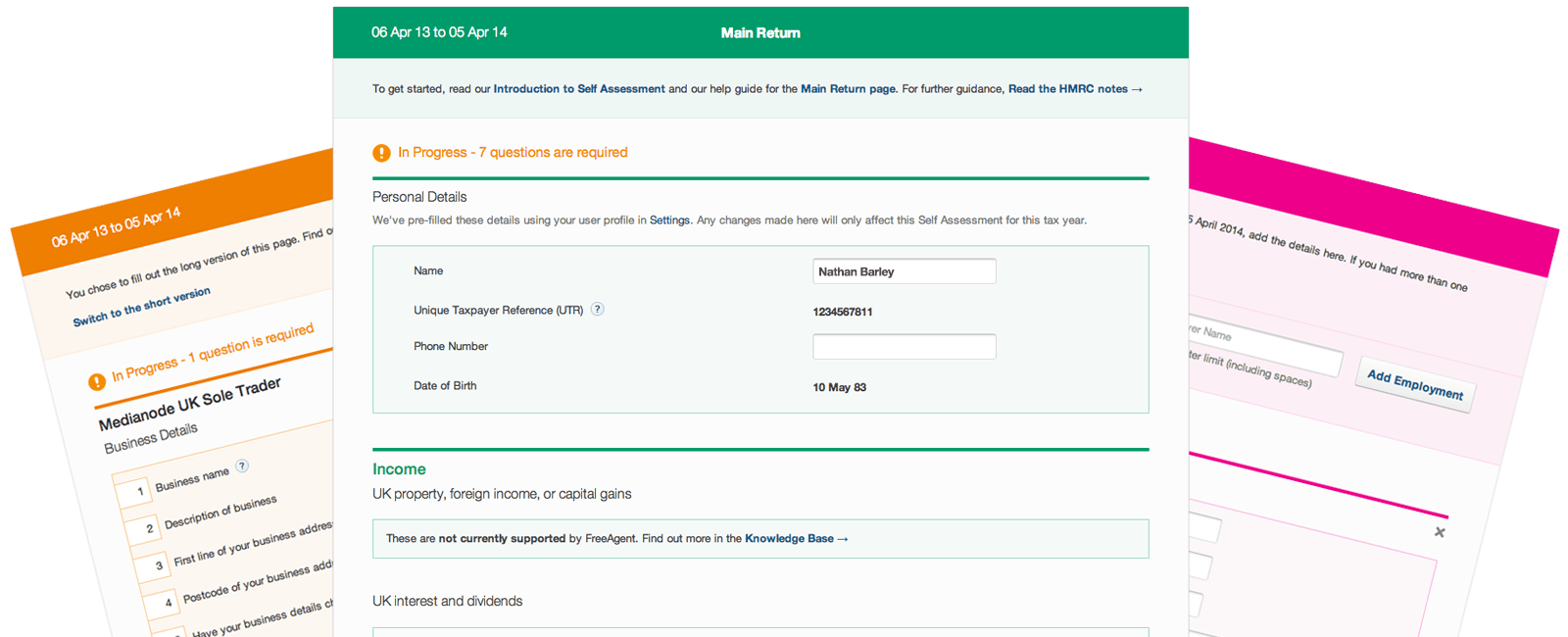

Preparing for your self-assessment

Using FreeAgent will give you the opportunity to collate the information you require for your yearly self-assessment tax return. Your Account Manager will be able to go through the information and check it is entirely accurate, and submit it to HMRC on your behalf. Bluebird Accountancy can also assist you with the tax return of one of your employees, if applicable.

Calculating your VAT

FreeAgent will automatically generate your VAT returns, as well as providing you with the dates for submission. This will save you a lot of time and when the information is collated, your Bluebird Accountancy Account Manager will be on hand to review the figures before pressing “submit” to HMRC.

Understanding your Corporation Tax

You will be able to access a Corporation Tax forecast, whenever you need it. This will be created by FreeAgent based on the information you have been uploading to your account. Your Account Manager will help you submit your Corporation Tax Return to HMRC.

Live banking

You can synchronise your bank accounts with FreeAgent and import your latest statements, as well as monitor your daily spending. The software allows you to label your individual transactions so that over time, you can generate an accurate business cash flow to help with your forecasting.

Planning your projects

The ‘projects’ section on your FreeAgent portal will allow you to track each of your assignments and calculate how profitable they are. You will be able to plan your activity, add notes and keep track of invoices. When finished, update your projects status to ‘complete’ so you can keep it for your future reference.